Chris Game

I had an interesting Budget week. I was part-hosting a Japanese academic colleague – Prof Toshihiko Ishihara (Kwansei Gakuin University) and his wife, Midori – making their first overseas trip since Covid. They briefly visited Birmingham, where Toshi was an erstwhile INLOGOV Associate, but were based in London, where I’d agreed to organise a theatre visit.

I’d booked tickets for a well-reviewed modern-day play, Romeo and Julie, loosely based on one of Shakespeare’s. Single-sentence synopsis: Julie – a bright, Cambridge University-bound, aspiring astrophysicist – is emotionally torn between uni and her affection for young single dad, Romeo, effectively sole carer for his baby daughter afflicted with Poonami.

No, the Poonami doesn’t feature in Shakespeare’s version, but, researcher that I am, I’d discovered it’s a real medical thing, meaning affected babies’ sudden, massive, uncontrollable bowel movements. Better still, that etymologically Poonami derives directly from the Japanese tsunami – a sudden, volcanic, unstoppable wave. My guests were delighted – and the play too was excellent.

The following Wednesday, however, was Budget Day – followed by the Birmingham Post’s impassioned coverage of our region’s “Power grab”, the “seismic shift in devolution as West Midland leaders take more control from Whitehall”, etc. (pp.1,7) – guaranteeing some amused but tricky questions from someone who both lives with and studies serious mayoral governance.

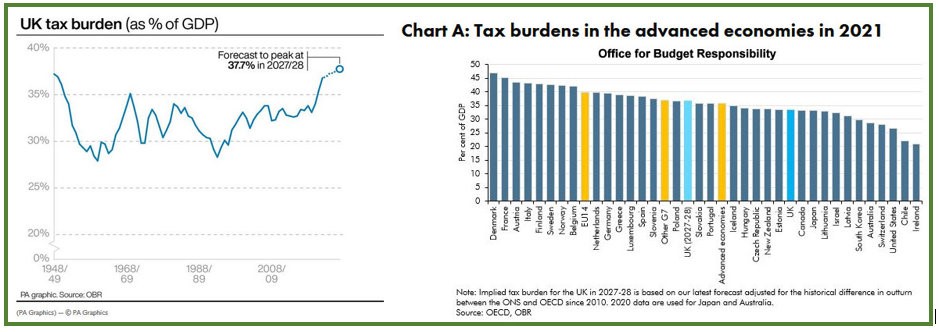

It was the national news headlines, though, that I was obliged to address first, and the UK’s “unsustainable … biggest since the war … tax burden” – characterised by Chancellor Jeremy Hunt as something horrendous and to be avoided, certainly by a Conservative Government, at almost any costs.

We’re not Basil Fawltys, but my Japanese friends and I tend not to mention ‘the war’ that much. Anyway, the timescale wasn’t really the issue. It was that highest-level tax forecast of 37.7% of Gross Domestic Product (GDP) – and yes, we do make life harder by colluding in almost invariably labelling it a “tax burden”, rather than, say, the “quality-of-life price” that the tax helps pay for.

What Toshi and other Japanese students of these things invariably query is: why the excitement/horror over a tax-to-GDP ratio currently almost identical to theirs? Yes, ours is indeed a higher ‘burden’ than those of, say, the US or Switzerland. But, as shown in the Office for Budget Responsibility’s Chart A, both we – at roughly 34% of GDP – and Japan are currently in the bottom third of “advanced economies”, and even at a forecast 37.7% we’d still be mid-table and some way BELOW both most sizeable West European countries, plus bits of Eastern Europe too.

It’s interesting. Pollsters never ask us if we prefer NOT being an ‘advanced economy’ – you know, one with fully staffed and functioning health and social services, decently funded schools, reliable public transport, etc.? And I’m not sure how collectively we’d answer. Clearly, these things do cost money, yet we obviously like visiting these higher-taxed places for our holidays. Not Denmark perhaps – top, with its 47% tax ‘burden’ – but France, Austria, Italy, Scandinavia, Greece, Spain, Portugal, etc.

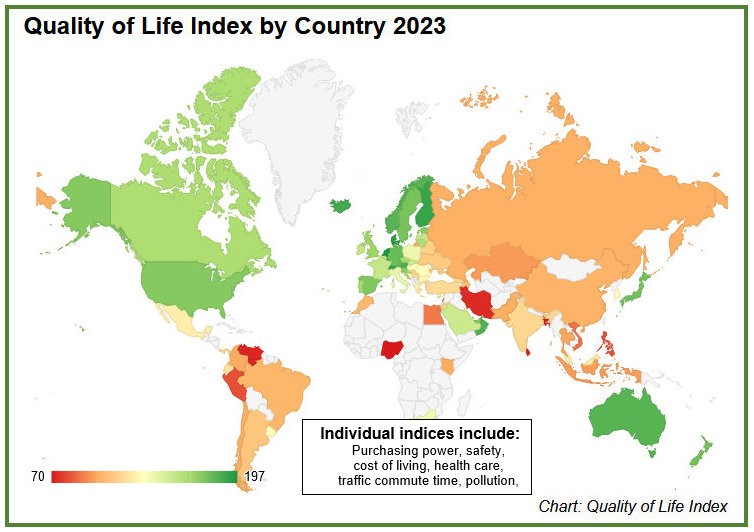

It’s presumably at least partly these countries’ ‘quality of life’ (QoL) that attracts us – which, unsurprisingly, correlates broadly with ‘tax burden’. There are several QoL indexes, one being Numbeo’s. It’s not the most methodologically sophisticated, but it does produce nice maps, collectively summarising its measures, which include purchasing power, safety, health care, cost of living, and pollution.

Netherlands, Denmark and Switzerland are currently top, scoring nearly 200 QoL points. Then the usual suspects – Finland, Iceland, Austria, Australia, New Zealand, Japan (13th) etc. – down to No.21 – UK 166.4, just ahead of Croatia. Disappointing, but could be worse – bottom at 84th is red Nigeria, not with ‘nul points’ exactly, but only 40.

The underlying, systemic problem, obviously not mentioned by Chancellor Hunt, is precisely his Department: His Majesty’s Treasury – first time I’ve typed that! – and its overbearing central funding control, currently exercised politically and communicated by him. And formerly by, among others, one George Osborne – which is where the irony starts. When Chancellor of the Exchequer, Osborne launched, and currently chairs, the Northern Powerhouse Partnership (NPP) – self-described as “the leading voice of business and civic leaders across the North”.

And currently a very shouty voice. For, within days of Hunt’s Budget pronouncements, along came Osborne with his NPP ‘wrecking ball’ – a clumsily titled but potentially headline-making report: Fiscal DevoNation – The Blueprint for How to Devolve Tax to the Regions of England. The Treasury, he and his Powerhouse chums now reckon – and as local government has complained for years – far from being the provider of solutions, is itself the problem. Its voice is the overwhelmingly dominant one in what Osborne nowadays sees as a damagingly over-centralised fiscal system. Just like when he was boss.

The NPP’s solutions involve, at least eventually, full-scale fiscal devolution. The “most unfair” council tax – with its outdated property values – stamp duty (paid on purchasing residential property), and business rates should all go, eliminating the Treasury’s all-powerful role altogether. The at least eventual replacement, following a comprehensive revaluation of all homes, would be a locally set land value tax, plus three new council tax ‘super bands’ for the most valuable properties, with revenue to be shared across the country.

Yep – that’s radical, but there’s more – like the localised hotel tax that numerous other countries already have, which NPP reckons could raise an annual £5.5 millions for the Lake District alone.

But I digress – from what my Japanese visitors really wanted to talk about: that Budget highlight of a “seismic shift” in devolution, to the West Midlands and Greater Manchester regions, and their elected Mayors, Andys Street and Burnham, who will get new multi-year devolution funding deals, and be allowed to retain business rates – to be followed by further such agreements across England.

At the time of writing, there hadn’t been a direct response from Northern Powerhouse as to how far down the ‘full-scale fiscal devolution’ road this might take us. As for a Japanese reaction, well, this blog is already overlong; but their response would probably start with the country’s written constitution, and the local government chapter guaranteeing its role and “the principle of local autonomy”. It’s an ultra-crude summary, but basically the national state does currency, diplomacy and defence, and pretty much everything else is left to the 47 prefectures and 1,700 or so municipalities. And heading those municipalities … directly elected mayors!

As the American phrase puts it: ‘Way to go’ – in both senses.

_____________________

This is an adapted version of an article that appeared in the March 23rd edition of the Birmingham Post.

Chris Game is an INLOGOV Associate, and Visiting Professor at Kwansei Gakuin University, Osaka, Japan. He is joint-author (with Professor David Wilson) of the successive editions of Local Government in the United Kingdom, and a regular columnist for The Birmingham Post.