Andrew Coulson

Our two main political parties are locked in a strange debate about the next budget, on 6 March. The elephant in the room is the underfunding of local government.

In the nearly 14 years of Conservative government, the core spending power of local authorities has been cut by 27% in real terms.[1] The County Councils Network has “warned that its members are under extreme pressure, and that the authorities they represent are set to overspend by almost £650m this year due to spiralling costs, particularly in children’s social care and home to school transport, which was contributing to a £4b funding deficit for those authorities over the next three years”. In addition an increase in the National Living Wage is expected to costs these councils £230m next year.[2] This has happened at a time when the ability of councils to raise their council taxes has been held down, for 2024-5 to below 5% for all but a tiny number of councils.[3] One of its consequences has been the inability of the employers in local government and the NHS to negotiate pay settlements which reflect the rate of inflation, or anything near it.

My reading of the present position is that Gove on the one hand and Rachel Reeves on the other are playing chicken. Each are waiting for the other to move first. They both know that after the general election a new government will have to settle the long-standing pay disputes in the public sector, and that it is not possible, year after year, for the pay of staff employed by local government and the NHS to rise by less the rate of inflation. The consequences are visable: depressed morale, a haemorrhage of experienced staff, and dependence on immigration to employ new staff. Rachel hopes that the Conservatives will be forced to confront this before the election. Gove wants the Labour Party to commit to doing it, because as of now any settlement is unfunded.

My view is that the understanding of inflation both by the two main political parties and the Bank of England is naive, especially as it relates to government policy. The starting point should be that inflation affects the distribution of income. It is an intrinsically political process. Most large companies and the richest people have means through which they can compensate for any inflation. Those who do not have the power or muscle to do so pay the price. Thomas Piketty[4] showed that inflation was the main means by which the middle classes paid for much of the costs of two world wars.[5] In those inflations, and in the last significant inflation in the UK, which followed the OPEC hikes in oil prices in the 1970s, the trade unions were strong enough to ensure that wages rose at around the rate of inflation. This is no longer the case.

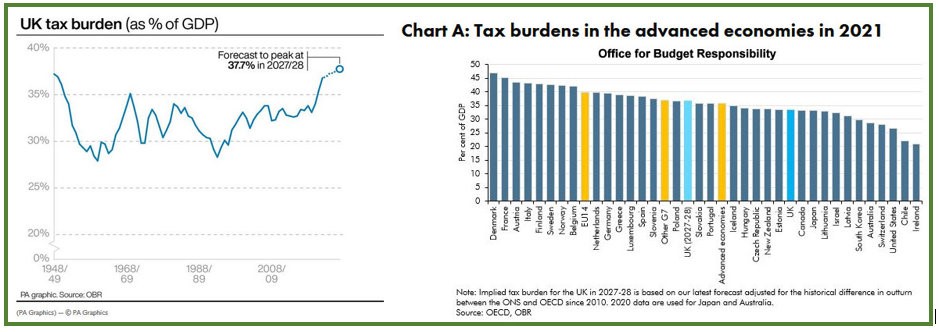

Yet the recent inflation has given the Government unprecedented increases in tax, which means that, if they so choose, they can afford wage increases. Most of this extra income arises from not raising the ceilings on higher rates of tax. Jeremy Hunt would like to use it to lower rates of income tax. The IMF (no less!) has told him that it is not appropriate to do so at this time.[6] The main reason, not always clearly stated, is that there are many unfunded challenges, but of these the public sector pay disputes (and perhaps the need for additional spending on defence, where difficulties in retention and recruitment are also partly a matter of pay settlements not keeping up with inflation) are top of the list.

Economists in the UK, the USA and other developed countries have had little to say in recent years about inflation. As if it is no longer a problem, which it probably isn’t if inflation stays at around 2%. But the present inflations, driven by wars, the climate crisis and the lockdowns, are another matter. Economic theory is little help. All the traditional theories have been shown to be false. It is not true that inflation and unemployment are opposites: we can have both together, so-called stagflation. Or that it can be controlled by limiting the supply of money, which is not possible when most of it is created by banks which lend far more than they hold in deposits. Or that it is either created by unexpected demands or by unexpected costs.

The British Government urgently needs to resolve the disputes about pay in the public sector, and to do so recognising that most local government employees are substantially worse off than they were before. The Labour spokesperson Angela Rayner has made the practical proposal of negotiating a three year settlement.[7] It cannot come soon enough.

Andrew Coulson is a nationally-recognised expert on scrutiny in local government and is particularly interested in governance by committee.

[1] Local Government Association, https://www.local.gov.uk/about/campaigns/save-local-services/save-local-services-council-pressures-explained 2024

[2] https://www.countycouncilsnetwork.org.uk/councils-in-significantly-worse-financial-position-after-the-autumn-statement-with-seven-in-ten-now-unsure-if-they-can-balance-their-budget-next-year/

[3] A prescient academic law professor, writing as long ago as 1984, wrote “It seems to me that the provisions for rate-capping … are little removed from a proposal to replace elected councils by administrative units. For a very long time, local inhabitants have enjoyed the right to elect local representatives with the power to tax, and so to determine, within modest political limits, what level of services shall be provided in the locality. … I have no difficulty in saying of an Act to put a limit on the rates leviable by a local authority that it is politically unconstitutional”. John Griffiths, in the Preface to Half a Century of Municipal Decline 1935-1985, George Allen and Unwin, 1985, p.xii

[4] Thomas Piketty, Capital in the Twenty-First Century, Harvard University Press, 2014

[5] The point was also made by one of his critics, Joseph T Salano, “War and the Money Machine: Concealing the costs of War beneath the Veil of Inflation” in John V Denson (ed.) The Costs of War, Routledge, 2nd edn. 1999

[6] David Milliken and William Schomberg, https://www.reuters.com/world/uk/imf-cuts-uk-growth-outlook-2025-after-stronger-past-performance-2024-01-30/

[7] “Rayner floats three year pay deal”. Municipal Journal, 14 Feb. 2024