Chris Game and Jason Lowther

If you wanted some serious reader attention for something West Midlands local governmenty, you really, really wouldn’t have chosen this past November. The war in Gaza was seriously hotting up, there were the COP 28 talks in Dubai, Christmas was coming, and Aston Villa were en route to becoming the Premier League’s “foremost home team”, whatever precisely that means.

Serious distractions, but competition for headlines was only part of the challenge facing the Resolution Foundation’s early November release of its In Place of Centralisation report setting out a proposed and far-reaching Devolution Deal for London, Greater Manchester, and the West Midlands. There were other diversions and potential confusions too.

It was barely a month since Birmingham City Council – the principal West Midlands local authority involved in this proposed ‘Devo Deal’ – had issued not one but two Section 114 notices, reportedly declaring itself doubly “bankrupt”, unable to meet the Council’s financial liabilities relating to Equal Pay claims and an in-year financial gap within its budget, and handing over its governance to Communities Secretary Michael Gove’s appointed Commissioners.

And, if that wasn’t potentially complicating enough – for those directly affected as well as onlookers – in that same previous month representatives of the West Midlands Combined Authority (WMCA) had ratified the “Deeper Devolution” aka “Trailblazer” deal announced in the Chancellor’s March Budget.

That deal, comparable to that agreed by Greater Manchester back in March, but relatively little of which we’d heard in the meantime, would devolve more powers to ‘Metro-Mayor’ Andy Street (or, given the May Mayoral elections, potentially his successor), the 30 WM local authorities (7 met boroughs, 4 unitaries, 19 districts) and their 6 million population, and simplify funding arrangements, with £1.5 billion to spend on long-term infrastructure projects and services such as transport, skills, housing and regeneration. A key element is a single block grant negotiated with the Government, like a central government department, as part of next year’s Spending Review.

Key ‘highlights’ include:

- A ‘landmark’ housing deal worth up to £500 million, offering greater flexibility to drive brownfield regeneration and funding to deliver “affordable housing at pace”;

- Greater control over local finance, including retention of an estimated annual £45 million of business rates for the next decade [hold on to that version of ‘local financial control’!];

- Up to six ‘levelling up zones”, backed by £25-year business rate retention, with an estimate total value of at least £500 million, to target investment and encourage regeneration in areas agreed with the Government;

- Measures to tackle digital exclusion, including greater influence over high-speed broadband investment across the region and a £4 million fund to get more people online.

In anywhere other than one of the most centralised governmental systems in the developed world, describing this package as ‘trailblazing’ would be wildly OTT. Here, though, it was rightly welcomed as constituting serious devolutionary progress, and Mayor Street, not surprisingly, was enthusiastic, seeing it as “marking the beginning of the end of … the ‘begging bowl culture’ where we must regularly submit bids for various pots of money on a piecemeal basis.”

Here’s the thing, though – well, two things, actually. First, the really rather big thing. The leading West Midlands council in this new ‘Trailblazer’ era is currently, following the issuing of those Section 114 notices, (a) in severe financial straits, and (b) being run until quite possibly 2028 not by elected councillors, but by Lead Commissioner Max Caller, his associate commissioners and political advisors – none of whom have ‘Trailblazing’ as a core part of their brief.

The second and, in Birmingham’s current circumstances, almost other-worldly thing, is the Resolution Foundation’s In Place of Centralisation report which is, incidentally, not the first RF report to be covered in these pages. It’s other-worldly too in the sense that it’s just one, albeit important, product of a bigger, wider-ranging academic project: The Economy 2030 Inquiry – a Nuffield Foundation-funded collaboration between the Resolution Foundation, an independent think-tank, and the LSE’s Centre for Economic Performance.

UK economic growth is their primary project – not boosting local democracy – one persistent obstacle to the attainment of which they identify as “the decades of underperformance of the big cities of Manchester, Birmingham, and more recently London” – the key cause being, they reckon, the centralisation of the British state. No startling news to INLOGOV blog readers, but a contrasting starting point to, say, that of the authors of Trailblazer deals, and their prescriptions go a good deal further.

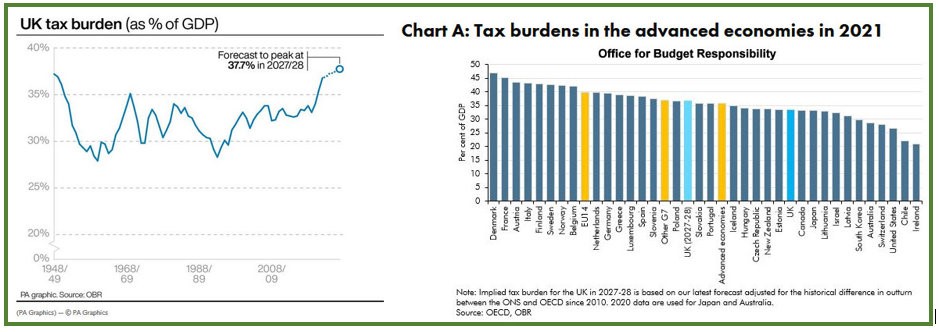

They start (p.4), unsurprisingly, from a different array of statistics, demonstrating the extreme centralisation of the British state.

Only 5 per cent of the UK’s tax revenues in 2019 were collected by local government, compared to 14 per cent in France, 23 per cent in Japan, and 35 per cent in Sweden. Accordingly, local government relies on grant funding, with only 19 per cent of all local spending in the UK funded locally, compared to 37 per cent in the average OECD unitary state.

They concede that “recent advances in devolution have begun to unwind this”, but, following a decade of austerity, significantly further fiscal devolution is required to improve growth without increasing inequality – in the form of a ‘triple deal’ negotiated between the Government and the Mayors of Greater Manchester, the West Midlands, and London as a trio, going “beyond the recent ‘trailblazer’ deals” and into which other mayors would be able to opt in the future.

The core of the triple deal would be fiscal devolution, “which would help to end the centrally-imposed local government funding crisis for the three cities by widening the local tax base, and resourcing improvements in the local economy.” Everyone would be a winner – the mayors, borough and Exchequer all benefiting from a new revenue-neutral fiscal settlement, including (pp.4-5):

- A local share of income tax receipts, with Greater Manchester and West Midlands keeping a larger share than London;

- Complete retention of business rates, and control over the ‘multiplier’;

- A single grant to the mayors distributed on a per person basis;

- The ability for mayors to reform council tax.

It would then be up to the mayors, in negotiation with the boroughs, to distribute this revenue across local government’s various responsibilities across their city. And in the medium-term?

Well, big IF … but the higher growth in the three cities that would be “likely”, if this fiscal devolution were accompanied by other policy changes, would then translate into higher local tax revenues for the mayors – with, by 2038, Greater Manchester raising between £49 million and £230 million, and the West Midlands between £40 million and £187 million beyond their current level of funding.

That was from p.5 of what is a 64-page report, so there’s a very great deal more explanation and explication. But the key, and hopefully obvious, point of this blog is to enable you, if it crops up in conversation, to disabuse anyone of the notion that the Resolution Foundation’s contribution to this debate is just ‘Trailblazer deals’ writ large.

Our view is that the current local government finance system is bust. Business rates penalise high street shops, the council tax is regressive with hopelessly outdated valuations, and councils spend too much energy chasing central government largesse through competitive funding pots. Democratically elected councils rely on a begging bowl and lack basic revenue raising powers that are commonplace internationally. We will be saying more on this as the General Election approaches…

Chris Game is an INLOGOV Associate, and Visiting Professor at Kwansei Gakuin University, Osaka, Japan. He is joint-author (with Professor David Wilson) of the successive editions of Local Government in the United Kingdom, and a regular columnist for The Birmingham Post.

Jason Lowther is Director of the Institute for Local Government Studies (INLOGOV) and Head of the Department of Public Administration and Policy at the University of Birmingham.