Chris Game

It was partly the timing. In combination, the suddenly increased likelihood of both Scottish independence and a Coalition break-up were bound to eclipse last Friday’s scheduled Second Reading of the Local Government (Independence) Bill. It was unfortunate, though. After all, local government independence would be a pretty big deal too, wouldn’t it?

You bet it would – though, if you’re at all serious about the betting bit, I’d suggest you check the bookies’ odds first. On a Scottish Yes vote you could get 2/1, and 66/1 on UKIP winning the General Election. On local government independence the giggling bookie would probably let you name your own odds.

That’s not to say that Friday’s events in Westminster weren’t important. They were, but they need setting in context.

The LG(I) Bill, not surprisingly when you hear its content, wasn’t a Government Bill, but a Private Members’ Bill, which limited its prospects for a start. Moreover, it wasn’t a Ballot Bill, introduced by one of the 20 lucky MPs whose names were drawn in the annual backbenchers’ ballot and whose chosen Bills stand most chance of eventually becoming law, partly through being prioritised on the limited number of Fridays set aside for private members’ legislation.

The LG(I) Bill was a Presentation Bill, microscopically few of which get anywhere near the Statute Book. True, there was a Protection of Birds (Amendment) Bill that apparently passed all its Commons stages in 67 seconds during one Friday sitting. That Friday, though, was in 1976, which explains why the LG(I) Bill’s sponsor, Graham Allen, Labour MP for Nottingham North, wouldn’t have been unduly optimistic, especially after seeing the Order of Business.

On an already curtailed parliamentary day, the LG(I) Bill was listed behind four Ballot Bills, headed by Liberal Democrat MP Andrew George’s Affordable Homes Bill – aka the Bedroom Tax (Embarrassing the Coalition Amendment) Bill – which made the improbability of Allen’s Bill being debated an effective certainty.

The Affordable Homes Bill would substantially undermine one of the Coalition’s most controversial welfare reforms, by allowing poor social housing tenants to retain their ‘spare room subsidy’ until they actually have somewhere smaller to live. The Lib Dems indicated they would join Labour in supporting George’s Bill, whereupon the Conservatives, unusually for a Friday, imposed a three-line whip on their MPs.

It guaranteed an extraordinary attendance, but not the defeat of the Bill, which received an acclaimed Second Reading by 306 votes to 231. It was a momentous loss for the Government, in substance, scale and in its damage to inter-party relations within the Coalition. Its immediate effect, though, was that debate on the second Ballot Bill was adjourned at 2.30, and Allen’s Bill wasn’t reached.

It was obviously disappointing, but not much more: at worst, maybe, only the end of the beginning. For in Graham Allen’s epic constitutional reform agenda, the most immediate objective was already achieved. The LG(I) Bill exists. It’s in the parliamentary machine, and Allen can proceed with his next stage of trying to convince all three main parties to pledge in their manifestos to support such a Bill in the next Parliament.

It’s ambitious, but perhaps not quite as quixotic as it sounds. For Allen is also the extremely active Chair of the Commons Political and Constitutional Reform Committee, whose major project throughout the present Parliament has been to explore the case for and against the UK having, like virtually every other country, a formally codified constitution.

With, I suppose, a forgivable and topical gesture, this project has been entitled ‘A New Magna Carta?’ and its first main product – a 400-page report, compiled in collaboration with King’s College, London – was published in July and put out to public consultation – http://www.parliament.uk/new-magna-carta-consultation.

The committee takes no views on the desirability of codifying the current heap of common law, Acts of Parliament, European treaties and unwritten conventions into a clearer, more balanced and democratic set of constitutional arrangements. That’s for us to say through the consultation process.

Rather, the report presents three blueprints of how codification could be approached: a Constitutional Code, a Constitutional Consolidation Act, and, most interestingly and set out in full in the report, a completely new written constitution by which the UK, with or without Scotland, would be governed.

‘Principles of local government’ get just one of 53 chapters in this draft constitution, but it is these principles, embodied in a statutory Local Government Independence Code – drafted, incidentally, by former INLOGOV colleague, Professor Colin Copus – that largely comprise Graham Allen’s LG(I) Bill.

The Bill’s purpose is to declare local and central government equal to and independent of each other, to separate their finances, to regulate the local-central relationship through a statutory code, and to set out procedures restricting any future parliamentary amendment or repeal of the code.

Many of the Bill’s provisions may sound fairly unexceptional. Local authorities’ accountability, the code would assert, is to their electorates, not to Whitehall. Local authorities are autonomous, democratically-elected bodies which independently decide upon, administer and regulate public affairs and deal with all matters of concern within their boundaries that are not the statutory responsibility of another body. A local authority’s geographical boundary can be altered only by a proposal from the authority itself or from its electorate.

These things would indeed be unremarkable in most countries, with less centrally controlled systems of local government. In our system, unfortunately, concepts like local and territorial autonomy, operational independence, and ‘all matters of concern’ are enough to seize ministers and civil servants with a collective attack of the vapours.

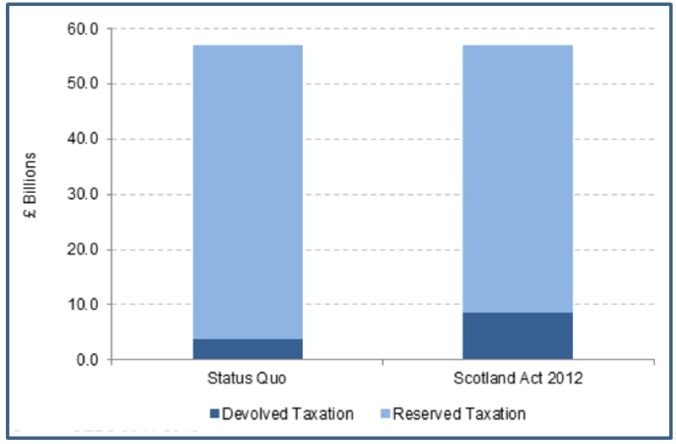

And that’s before we get near to the real biggie: ‘local government financial integrity’. Local authorities, the code would declare, shall be financially independent of central government, which may not place any restriction on decisions by local authorities about the exercise of their financial powers.

Each local authority shall receive from central government an agreed and guaranteed share of the annual yield of income tax. Local authorities may, with their electorates’ consent, raise additional sources of income in their areas in any way they wish – just like the Scots, if they behave themselves and vote No. Central government shall not cap, or otherwise limit, local authorities’ taxation powers.

All that and more is in the first of nine Schedules. These substantive proposals, though, are possibly not constitutionally the most radical. That prize would probably go to the hurdles facing any future government seeking to amend or repeal the code: a minimum ‘super-affirmative’ requirement of unanimous approval by each parliamentary House, or by a two-thirds majority of the total membership of each House.

Which is why I suggested at the start of this blog that the LG(I) Bill’s lack of progress on Friday was only partly about its timing. Even without the Affordable Homes Bill, and setting aside much of the LG(I) Bill’s own content, the idea of abolishing two of Parliament’s most precious rights – to determine the country’s level of taxation, and to change or repeal any previous legislation – would be several bridges too far for many MPs.

For the present, therefore, local government independence must be considered to have been put on hold – though not, one can but hope, indefinitely.

Chris Game is a Visiting Lecturer at INLOGOV interested in the politics of local government; local elections, electoral reform and other electoral behaviour; party politics; political leadership and management; member-officer relations; central-local relations; use of consumer and opinion research in local government; the modernisation agenda and the implementation of executive local government.