Chris Game

Did you see manager Arsène Wenger’s explanation of Arsenal’s feeble performance against Manchester City last Sunday? While most players are galvanised by home supporters and see playing at home as an advantage, Arsenal’s apparently are scared by theirs. “They have a great desire to do well, so maybe they’re a bit too anxious that they don’t respond completely to the expectation level of the crowd.”

A strong bid, certainly, for this week’s You-couldn’t-make-it-up prize, were it not for the Department for Communities and Local Government (DCLG), who, not satisfied with inventing their own measure for disguising the severity of their grant funding cuts to councils, have now disguised it still further by double-counting. If the whole grant-slashing exercise weren’t so serious, the ineptitude really would be laughable. Ridicule aside, it can only serve to validate and reinforce the allegations of unfairness that core city leaders in particular have been making.

Nick Forbes, Newcastle City Council leader, kicked off in November, writing personally to David Cameron to complain about the ‘unfair’ impact of funding cuts on councils like Liverpool with cheap housing and therefore a low council tax base. Then on December 19th, local government finance settlement day, the leaders of all seven English core cities – Birmingham, Bristol, Leeds, Liverpool, Manchester, Newcastle and Sheffield – wrote jointly to Local Government Secretary, Eric Pickles, demanding an urgent meeting to address the “looming financial crisis” their authorities were facing.

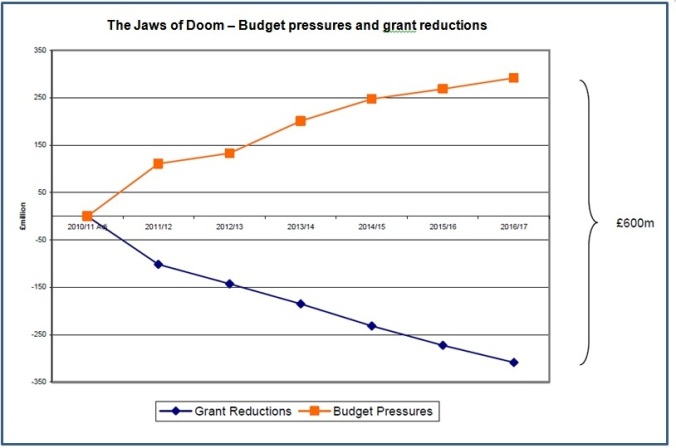

The scale of the potential crisis was illustrated by reference to the ‘Jaws of Doom’ graph – Birmingham’s version of Barnet Council’s now famous and similarly apocalyptic ‘Graph of Doom’, produced by the London borough to shock residents, but particularly Ministers, into realising that by 2020 councils would be facing a £16.5 billion shortfall, with no money left for anything apart from children’s services and adult care.

The ‘Jaws of Doom’ graph appears in Birmingham City Council’s budget consultation document (p.8) and does indeed resemble the gaping jaws of a crocodile, attacking from stage left, but unable to swallow the monstrous £600 million budget deficit for which the council estimated, last October, it was heading – and now, following the finance settlement, closer to £625 million.

This is on top of the £275 million of mainly ‘efficiency and transformational’ savings, including a 25% staffing cut, already made over the past two years, and that have brought the council to the point where the Labour administration, elected last May, claims further efficiency savings are no longer enough. The severity of the reductions in government grant will necessitate significant cuts in front-line services. Hence the budget consultation: outlining the Council’s proposed four-year savings programme, and seeking residents’ views on detailed service cuts for 2013/14, and on alternative council tax scenarios – a further freeze, a limited increase of under 2%, or a larger increase requiring referendum approval.

One question, however, that the consultation document neither asks nor, judiciously, attempts explicitly to answer is: IS IT FAIR? So I thought I’d have a go.

Are Birmingham and urban councils generally, or Labour councils, or the most deprived areas, being particularly harshly treated by these grant funding cuts? Or was Pickles right, when he insisted in his finance settlement statement that “overall the average spending power reduction for councils in 2013/14 is expected to be limited to just 1.7% per household”, and that “concerns that the poorest councils would suffer disproportionately are well wide of the mark”?

Well, let’s start right there, with that phrase ‘spending power’ (SP) reduction – used by Pickles and his civil servants in preference to the ‘grant reductions’ quoted by council leaders and measured by the ‘Jaws of Doom’. Are they different? You bet. SP was introduced in 2010/11, when the new Government announced its intention to cut central government grant funding of council revenue spending by an unprecedented 28% in cash terms (nearer 40% in real terms, allowing for inflation) over four years, with 21% ‘front-loaded’ in the first two years.

To disguise the savagery of that front-loading, and to make before-after comparisons more difficult, the DCLG first restructured the whole grant allocation system, and then created ‘revenue spending power’ – a measure Ministers claimed that, by including council tax receipts, certain specific grants, and NHS social care funding, gave a fuller picture of a council’s overall financial position. Fuller, yes, but not full. If it really was a full, rather than politically beneficial, picture that Ministers wanted, they could have included income from fees, charges and investments. These, however, are income sources that tend to decline in a recession and whose addition to SP would emphasise, rather than de-emphasise, councils’ grant dependency – so nothing like as helpful as the DCLG’s contrived measure, which could instantly reduce a 28% grant cut to a 14% cut in spending power.

You’d think this was sufficient, but this year, it seems, they’ve really over-egged the pudding by double-counting council tax support in two separate elements of SP. Sadly, at the time of writing, the Department was refusing to help Local Government Chronicle journalists with their enquiries into how the double-counting occurred, and whether it was intentional or accidental. Either way, Pickles’ claim of an average 1.7% spending power cut in 2013/14 was clearly wrong and should have been about a percentage point higher.

Having changed the system and invented new terminology, Ministers’ next rule is always to describe funding reductions in overall percentages, not cash. This fools no one who gives a moment’s thought to how grant funding works, but then there are plenty who don’t.

Formula Grant – the general grant allocated in the annual finance settlement – is calculated in four blocks, the two key ones being Relative Needs, to compensate for areas’ differing service needs, thereby broadly reflecting economic and social deprivation; and Relative Resources, reflecting the strength of an area’s council tax base and ability to raise its own revenue. In combination, these two elements mean some councils are much more reliant on central government grant than others. The more deprived the area, the greater is its need for council services, the lower its council tax base and tax receipts, and therefore the higher the proportion of its revenue spending that needs to be funded by central grant.

Overall in 2012/13, 27% of councils’ revenue spending is funded through council tax. But that proportion ranges from averages of 16% and 22% among Inner London and metropolitan boroughs to over 50% among shire districts. Even neighbouring councils’ grant/tax ratios can differ considerably – like Birmingham’s 84% grant/16% council tax and Solihull’s 67%/33%. What can be presented, therefore, as a uniform 10% grant cut across the country means for Birmingham a budget cut of 8.4%, for Solihull one of 6.7%, but for some shire districts barely 2%. Not so uniform after all.

The reforms to specific or targeted grants have hit councils in deprived areas relatively harder still. Some grants specifically conceived for deprived communities, like the Working Neighbourhoods Fund and area-based grant, have been run down or scrapped altogether. In contrast, the Council Tax Freeze grant to councils agreeing to follow the Government’s tax-freeze policy comprises a 3.5% addition to a council’s existing tax revenues, so benefiting most those with higher tax bases. Likewise, the New Homes Bonus Scheme, funded by top-slicing the central grant to all authorities by equal proportions, benefits disproportionately those in the south, where the bulk of the building is.

Obviously, there have been and will continue to be numerous other technical changes in the grant funding system, with criss-crossing impacts on different kinds of councils. Even a year ago, though, the Audit Commission’s Tough Times report was clear that “there is a strong link between local deprivation and the scale of funding reductions”, with “deprived areas in the north, the midlands, and inner London [experiencing] the greatest cuts”.

There have been several comparisons of the scale of funding cuts across individual local authorities, among the most accessible being the Guardian newspaper’s analysis and interactive map. English local authorities were found to be facing, on average, a cut of £61 a year per person in the total central government funding they would receive between 2011 and 2014, but the range extended from over £250 per person in Hackney, Liverpool and Knowsley to North Dorset’s £2.70.

The severity of cuts correlated closely with the Government’s own Index of Multiple Deprivation (IMD), examples including Liverpool – IMD 2nd, funding cut 2nd (₤252); Manchester – IMD 4th, funding cut 5th (₤210); and Birmingham – IMD 13th, funding cut 16th (₤166). Of the 30 councils facing the severest cuts, 28 are currently Labour controlled. All of which suggests – returning to Pickles’ other bluster from his finance settlement statement – that “concerns that the poorest councils would suffer disproportionately” are not so wide of the mark after all, and certainly not as wide of it as his own 1.7%.

Chris is a Visiting Lecturer at INLOGOV interested in the politics of local government; local elections, electoral reform and other electoral behaviour; party politics; political leadership and management; member-officer relations; central-local relations; use of consumer and opinion research in local government; the modernisation agenda and the implementation of executive local government.

Thanks for this excellent analysis, Chris, showing the injustice in the massive cuts in central government fiscal transfers to local government under the present government – with the poorest municipalities being hardest hit.

You also point out that the consultation document of the Birmingham City Council, one of the hardest hit municipalities, fails to address this fundamental issue of fairness. Indeed this is most odd. I went to one of the three consultation meetings (none of which, incidentally were held in the most deprived parts of the city) and it really amounted to a lecture by Albert Bore, a Labour Party politician and leader of the council. No-one could fault his ‘jaws of doom’ analysis by power point presentation. But as I listened, it struck me that anyone who did not know him would think he was a council officer and not the political head of the municipality. He ended by giving the various technical ‘alternatives’ to deal with the massive cut in central government grant and at no point did he raise the need to oppose the injustice of the central government cuts, something that virtually everyone present at the meeting was calling on him to do. I found his attitude profoundly depressing. It confirmed my conviction that what we have in England is a highly centrally system of local administration’ – led by local politicians whose mindset is to submissively operate under the control of central government and that we simply do not have ‘local government’ as in most other European countries. This situation is now becoming intolerable and I am so pleased that Communities Against the Cuts (CATC) is fighting tooth and nail to oppose this craven submission of Birmingham City Council to central government diktat.

Pingback: The Jaws of Doom – still relevant a decade on | INLOGOV Blog