Chris Game

“Later, I heard that Hilary Benn had been appointed [as a Minister for International Development in a 2003 Blair reshuffle]. Lucky old Hilary. That’s the second time he’s stepped into my shoes, but I can’t complain. He’s brilliant.”

Deliverer of this unusually effusive politician’s compliment was the actor playing Chris Mullin, the former Sunderland Labour MP and junior minister, whose well-received diaries were recently adapted into one of the more surprising of recent London theatre hits, A Walk On Part: The Fall of New Labour.

Well, with due respect to Mr Mullin, his hero hasn’t been so brilliant – or even, apparently, honest – in his attempts to spin this year’s council tax figures to his party’s advantage.

On April 16, Mr Benn, Labour’s Communities and Local Government Spokesperson, posted a news items on Labour’s official website, headed ‘New figures reveal residents in Labour areas pay less council tax than in Tory or Lib Dem areas’.

Nothing remarkable there, I agree. It could have been an early April headline from pretty well any year since Labour decided that tax-raising was an embarrassing activity for a social democratic party to be engaged in. Still, I did wonder where the ‘new figures’ came from, as the only ones I knew of that analysed by political control were those helpfully produced by Matthew Keep in the House of Commons Library (Council Tax 2012/13 – Standard Note: SN/SG/6276).

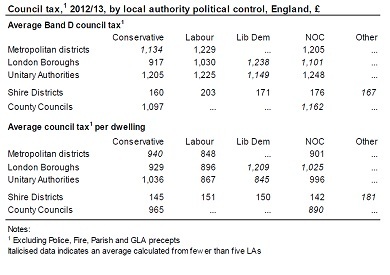

As a politician, Mr Benn sees no need to source his ‘new figures’ or the ‘research’ that produced them, but they are at such variance with those of the Commons Library – as in the table reproduced below – that they are worth comparing, or contrasting, more closely. It may be, of course, that Mr Benn’s data are somehow more complete than those in the table, or maybe differently calculated – in which case it’s a particular shame that we weren’t informed.

Benn: ‘Households in Labour-controlled authorities pay on average £220 less per year than those in Tory areas and £101 less than those in Lib Dem areas’.

Commons Library: Partly wrong. Households in Labour-controlled London and metropolitan boroughs and unitaries do pay less on average than those in Conservative areas, but the difference is much less than £220 p.a., and in shire areas those in Labour-controlled districts pay slightly more. Comparisons with Lib Dem authorities vary more by type of authority.

None of this, it should be emphasised, is surprising. Indeed, the surprise would be if the picture painted by Mr Benn’s figures really were true. The truth, however, is that this is one of the more irritating ritual arguments in which the major parties engage every year in the period between council tax-setting and the local elections. It has become an inevitable by-product of the way in which our unreformed tax system works – as I sought to explain in this space last April.

The tax base for council tax is a ratio system centred around Band D: Band A paying 6/9 (2/3) of Band D; Band B 7/9, and so on up to Band H paying 18/9 (2x) of Band D. Councils calculate their tax base by weighting the number of dwellings in each band to Band D, and report their budget headlines in terms of ‘Council tax for council services (Band D)’.

Band D has thus become a benchmark for comparative purposes, and it is therefore perfectly reasonable that the Conservatives tend to use it – as they could with this year’s Commons Library figures – to claim that average Band D tax rates are normally lower in Conservative than in Labour or most Liberal Democrat areas.

Reasonable, but disingenuous. Not so much because only a small minority of properties (15% in England) are actually in Band D, but because, exacerbated by the absence of any revaluation since 1991, the mix of property bands across authorities and regions nowadays varies starkly. In my own authority of Birmingham 56% of properties are in Bands A and B, and just 14% in Bands E to H combined. Neighbouring Solihull has 19% A and Bs and 41% E to Hs. In the North East there are 56% Band As, in the South East 9%, in London 3%.

All of which obviously means that, to raise a certain tax income in an authority with mainly Band A to C properties requires a significantly higher Band D tax than in one comprising many E to H properties. The average bills paid by tax payers will vary similarly – being generally higher than the Band D figure in affluent and Conservative-inclined areas, and lower in poorer or Labour-inclined ones.

Hence Labour’s equally disingenuous preference for using average tax bill figures as their political comparators. North East: Average Band D council tax £1,525; average tax bill per household £1,072. South East: Average Band D council tax £1,475; average bill per household £1,381. As the anthropomorphic Russian meercat, Alexsandr Orlov, would confirm: simples!

Mr Benn, though, wasn’t finished. His ‘research’ had also revealed that more Conservative than Labour councils had rejected the Government’s one-off grant in exchange for freezing or reducing their council tax in 2012/13. “16 Tory councils have increased council tax this year, as opposed to 15 Labour councils”.

This really is foolishness, on several different levels. First, is Benn really suggesting the 15 Labour councils were wrong: that they should have cravenly fallen in with the Government’s capping policy and accepted the one-off grant, even if they judged it detrimental to their residents’ longer-term interests? If so, it’s interesting that we didn’t hear more about it at the time, when Eric Pickles and his fellow Ministers were positively bullying Conservative councils into obedience.

Second, aren’t the numbers of councils controlled by the respective parties just a tiny bit relevant here? The Conservatives have roughly two-and-a-half times as many as Labour, which makes the 16-15 comparison look a bit lame.

Third, if Benn really is following Pickles’ line – that it was councillors’ moral duty in these austere times to freeze council taxes – it’s presumably worth taking account of the percentage increases imposed by the respective groups of offending councils, and how close they came to exceeding the 3.5% that would have triggered a referendum.

The full list was published by the Local Government Chronicle on March 21, and, by my calculation, the average Conservative council increase was under 3%, while Labour’s average – with 8 of their 15 going for the full 3.5% – was 3.27%.

Mr Benn’s brilliance, it would seem, is more in the field of international relations than local government finance.

Chris is a Visiting Lecturer at INLOGOV interested in the politics of local government; local elections, electoral reform and other electoral behaviour; party politics; political leadership and management; member-officer relations; central-local relations; use of consumer and opinion research in local government; the modernisation agenda and the implementation of executive local government.

The flaw in this article is the phrase ” to raise a certain tax income “, which isn’t what Council Tax is for, either in theory or in practice. Council Tax (pre-resource review) raises an amount which, when added to governent grant, raises a certain income, the ‘certain’ being the amount the boffins behind the funding formulae think each council needs.

It is therefore impossible to think about Council Tax, and how it varies around the country, without addressing the distribution of government grant. If the grant allocation system is assumed to be objective, comprehensive and fair (everyone in local government finance reading this is now of course horizontal) then the key is what the grant system was originally supposed to achieve. My distant recollection is that the original objective was to allow for both variations in need and ability to pay (as reflected by the proportions of local homes in each band) such that the Band D rate ‘should’ be the same around the country. This tends to give greater weight to the ‘band D’ comparison and less to the ‘average paid’, which we should expect to be lower in areas with poorer people and property.

However the reality is of course that the grant system attempts the impossible to start with, there are more people alive who understand the Schleswig-holstein problem than local government grants even today, and it is awash with damping, smoothing and adjustment factors that mean most councils aren’t getting the amounts even the formula says they should. This weakens but doesn’t undermine entirely the ‘band D’ comparison..

The final missing consideration is, of course, that any measure of price is not very helpful without some corresponding measure of what our residents are getting for their money.